Balancing the Yachting Lifestyle with Financial Freedom

When you work on a superyacht, you’re going to come into contact with two classes of people. Those who have financial freedom and those who don’t. You probably know them better as ‘the owner and the guests’ and ‘your crewmates’.

So how do you get from one side of the divide to the other? How do you become financially free?

First, let’s consider what ‘financial freedom’ actually is. Many superyacht crew think they already have it when, in reality, they don’t. The same can be said for lots of people, so it’s not just a yacht crew thing. And it’s entirely understandable.

When you’re young, at the start of your working life, possibly in your first or second job, it’s tempting to think that earning a salary makes you financially independent. After all, you’re the one making the money. You’re the one able to pay your way in life without the help of someone else.

But that just means you have money coming in. That’s not the same as financial freedom.

Actually, it’s the exact opposite.

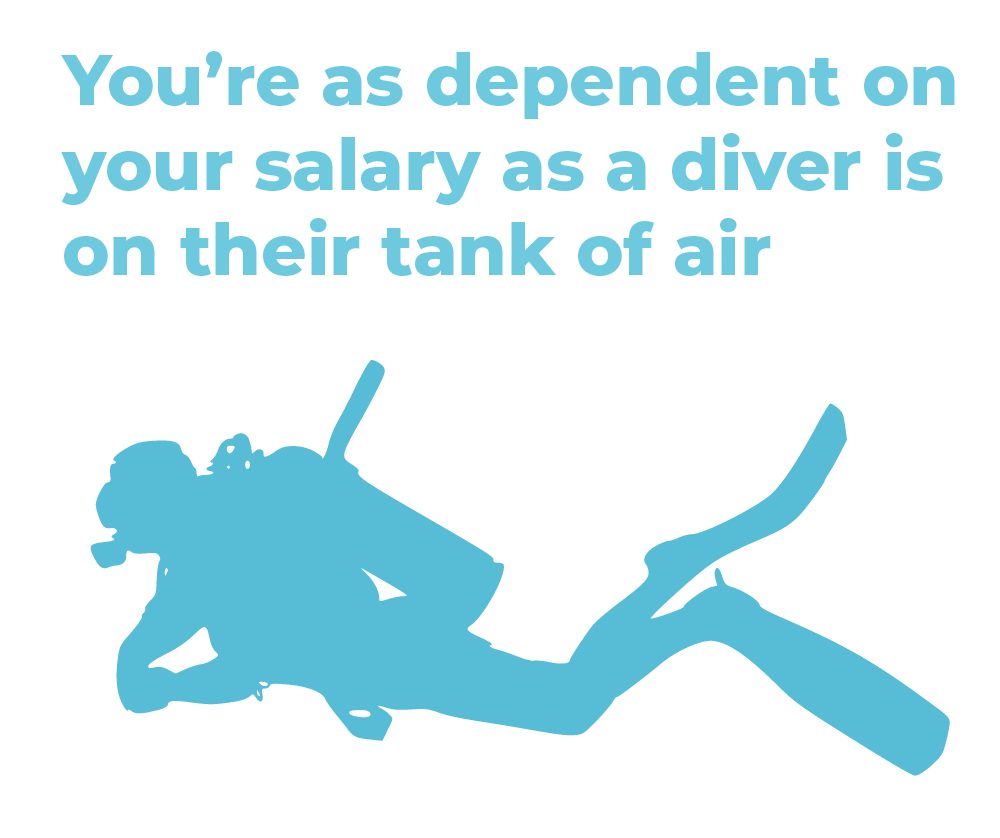

If you’re relying on a salary, that’s the purest form of financial DEPENDENCE. You are completely reliant on that job for money. Without the job, your source of money would dry up and you’d have to go and find another one.

What is genuine financial freedom?

Financial freedom is the opposite. The owner of the superyacht has it. And so do the guests you serve. Sure, some of them may have a job. CEO of a multinational empire or queen of something. If they are fired tomorrow, it’ll barely register in their bank balance.

Their money tap won’t be turned off because they already have plenty of wealth built up. Much of this wealth will be in assets that will continue to make them money. Stocks, bonds, commodities, companies, intellectual property, real estate—the list is endless.

So regardless of what they are doing, they are making money.

The same goes for the guests on board. Each one probably makes more in a day than you will during the whole Med season. And they’re doing it while you’re serving them drinks and polishing the jet skis.

That is financial freedom.

Put bluntly: financial freedom means without lifting a finger, your money tap keeps flowing. You can work if you want to (doing exactly what you want, according to your own rules and priorities), but you don’t have to. Your bills are covered regardless.

Compare that with your situation.

If you lose your job this instant, it’s likely your money source will vanish with it. Unlike someone who is financially free, you’d have to go out and get a job. And it’ll be on the employer’s terms, not yours. Also, you’ll be working to their priorities and schedule, not your own.

OK. You get the picture. You don’t have financial freedom.

But you could.

How you can become financially independent

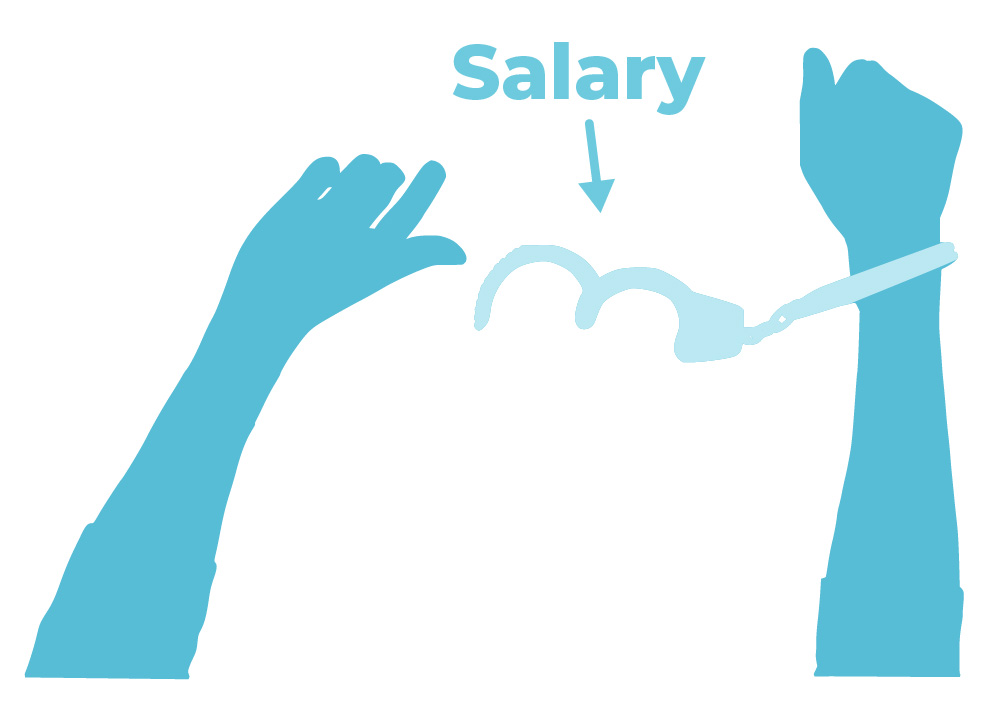

Having a salary isn’t the same as having financial independence. A salary is a set of handcuffs that you need to free yourself from.

While you don’t share much, if anything at all, in common with the owner or the guests, you can work towards enjoying the financial freedom they have. Rather than thinking you’ve arrived already, you’re in a place where you understand you’re at the start of your financial journey.

This is an important mindset to have because it will strengthen you. It will help you avoid the main pitfall of working in a luxury environment: thinking you are participating in the luxury, rather than providing it.

Sadly, we’ve seen it time and again: yacht crew get seduced by the opulence that surrounds them and start aspiring to it. As a result, they spend their money on a lifestyle that mimics what they see. Expensive clothes, drinks, holidays, electronics, cars, etc.

It’s understandable. Spending like that is tremendous fun.

But take it from us, it’s not half as much fun as reaching a point in your life where you are financially independent.

No amount of luxury goods can compare to the feeling that comes from knowing you can do whatever you want with your time.

We’ve been very privileged to help many superyacht crew reach a point in their lives where they are able to do just that. Each one says how incredible it is to be in total control of the time they have on Earth.

Remember: your life is a limited-time offer.

And genuine financial freedom will allow you to make the most of it.

Juggling the superyacht lifestyle with financial freedom

So armed with the knowledge of what financial freedom is and the life-changing impact it can have on you, aren’t you interested in pursuing it?

If you are, here’s some good news for you.

Financial freedom is very simple to achieve.

There’s no secret here. And it’s not rocket science. (Surprised to hear that from financial planners like us? Read on.)

If you want to become financially independent, just build up the money you need.

You do that by:

- setting a target of how much money you need,

- limiting your spending (enjoy yourself, of course, but within reason),

- maximising the amount you save,

- putting your savings into a savings plan rather than a savings account,

- keeping going until you reach the target.

See? Simple.

Easy? That’s another story.

If it were easy, everyone would be financially independent. You’ll have noticed that they aren’t.

That’s because there are many pitfalls along the way to financial independence.

Here are the two biggest:

- Failing to start

- Failing to keep going

The reason many people don’t start is because they don’t really know how to. At best, they might put a little bit of money into a savings account or into something that tracks one of the big stock indices. At worst, they do nothing at all.

But they won’t have a target, a plan nor a properly structured investment portfolio that will get them to where they want to go financially.

That’s where we come in. We’ll help you figure out your starting point, your finish line and how you’re going to get from one to the other.

But what about the second biggest pitfall?

The reason most people who start towards financial freedom ultimately end up failing is because they stop and never get going again.

There are lots of reasons for this, but really they all boil down to a single point of failure: they’re on their own trying to achieve a huge goal in the face of the relentless challenges that life throws their way. Is it any wonder many simply give up?

That’s where we come in again. We’ll guide you all the way to the finish line. We’ll be there when life gets tough and you’re tempted to pull the plug on your financial plan.

Our job isn’t to sell you investments. Our job is to help you become financially independent. That means we’re in it for the duration. We’ll be there at the end, not just the start. When you’re facing into the headwinds of life, we’ll help you to keep going.

Believe us when we say you’ll need that help, because the harsh reality is that your financial success doesn’t fit with the priorities of most people you know.

That’s hard to read, we know. But it’s the naked truth.

Overcoming the biggest hurdle to financial freedom

We once spoke with someone whose teenage nephew was on the books at a Premier League football club in London. The young man was dedicated to becoming a professional footballer. He had the right mindset, plenty of work ethic and bags of talent.

His uncle told us that, despite his dedication, his nephew would probably fail. He said the club itself had told him so. They said that it wasn’t his nephew’s attitude that would likely derail the young man, but the attitude of those around him. Most of the people around him would give him advice or encourage behaviour of him that suited their own agendas, not his. According to the football club, that was a big reason many talented young footballers dropped out of the academy.

Remember: your friends and crew mates want you to have fun with them today, rather than see you be financially free at some abstract point in the future.

As for the owner and the guests? They want another chilled Sauvignon brought to them, while their assets add more money to their net worth.

If you want to cross the divide between those who have financial freedom and those who don’t, you’ll have to take action yourself. But you don’t have to make the transition happen all alone.

Together, we can get you across that divide.

How about it?